Bankruptcy Law Firm

Serving the Wisconsin and Illinois Areas

Schedule an Appointment

Call Us Today for A Free Consultation!

Milwaukee Location

626 E. Wisconsin Ave. Ste 1000

Milwaukee, Wl 53202

Phone: 1-414-272-0077

Toll Free: 1-866-872-8363

Chicago Locations

Downtown, 55 E. Monroe Suite 3800

Oak Park, 1010 Lake St, Suite 200

Hyde Park, 5113 S. Harper, Suite 2C

Phone: 1-312-801-3000

Toll Free: 1-866-872-8363

BANKRUPTCY BLOG

BANKRUPTCY BLOG

Credit Solutions, SC is an experienced bankruptcy law firm serving Chicago, Milwaukee and everywhere in between. We help you find the best solution to better your financial situation.

Staying current on the latest developments in bankruptcy and credit laws allows our lawyers to use them to your best advantage. Credit Solutions understand the stress involved in considering bankruptcy. Our bankruptcy lawyers coordinate our collective knowledge into a blog informing you of your rights and the options available for resolving your debt.

Our blog addresses the latest laws governing credit cards, home loans, car repossession, and more, providing you up-to-date information about improving your credit and protecting your possessions.

As most people prefer to keep their financial information private, utilizing the information in our blog allows you to confidentially find the answers or solutions you need to your financial situation. From deciding which bankruptcy chapter best protects your assets to using the latest credit card laws to your advantage, Credit Solutions’ blog offers the pertinent information for brightening your financial future.

By Credit Solutions

•

02 Aug, 2018

The Bankruptcy Means Test has been used for 10+ years now, but it can still be a source of confusion. Learning what the practical application of this test is, and how it applies to your case is the first step.

By Credit Solutions

•

22 Dec, 2016

How can Chapter 7 and Chapter 13 bankruptcy help in stopping a shut off? Bankruptcy can offer immediate relief if you're facing a utilities shut off, whether it's during winter or any other time of the year. In order to prevent a shut off and file for bankruptcy, you may need to file an emergency petition, which allows you to start the process and halt the utility shut off proceedings. However, it is crucial to complete the remaining forms within 14 days to ensure the viability of your bankruptcy case. Failure to do so could result in the dismissal of your case by the bankruptcy court. Moreover, filing for Chapter 13 bankruptcy can also be instrumental in stopping a shut off. Once you have filed for bankruptcy, utility companies are legally prohibited from attempting to collect any outstanding bills, be it through mailed statements, phone calls, or even lawsuits. It is important to note, though, that filing for bankruptcy only protects you from previous debts, and you are still responsible for paying new utility bills after the bankruptcy filing. Contrary to bankruptcy, a Chapter 128 non-bankruptcy does not provide the same relief in preventing a shut off. Chapter 7 bankruptcy offers immediate relief for individuals facing a utility shut off, whether it's during the winter or any other time of the year. In such cases, filing an emergency petition can help prevent the utility shut off process. This petition allows you to initiate the bankruptcy process and halt the utility shut off, with the option to complete the remaining forms within 14 days. However, it's crucial to file the remaining forms within this timeframe to avoid the risk of the bankruptcy court dismissing your case. Once you have successfully filed for bankruptcy, the utility companies are prohibited from attempting to collect any past due bills through mailed statements, phone calls, or lawsuits. This protection provides individuals with a much-needed respite from the burden of overdue utility bills. It's important to note that filing for bankruptcy only shields you from previous debts, and you will still be responsible for paying new utility bills that arise after the filing. Alternatively, a Chapter 13 bankruptcy presents a broader range of benefits for the right situation in addition to stopping utility shut-offs. It allows individuals to catch up on missed mortgage or car payments through a repayment plan, effectively preventing foreclosure or repossession. This chapter also provides the opportunity to safeguard valuable assets that may be at risk in a Chapter 7 bankruptcy. Moreover, the structured nature of the Chapter 13 repayment plan instills financial discipline by requiring regular monthly payments over an extended period. This promotes responsible financial management and cultivates good financial habits for future stability. What are the requirements for utilities during the winter heating moratorium? In Wisconsin, a winter utility shut off is banned between November 1st and March 31st. Utilities banned from disconnection include water, electricity, sewer, gas, and phone. Electricity and natural gas, in particular, cannot be turned off between November 1st and April 15th. This means that customers who are behind on their bills during this moratorium period are protected from having their heat-providing service disconnected. However, it is important to note that while utilities are prohibited from disconnecting customers during the winter heating moratorium, consumers who have already been disconnected must still make arrangements to pay their outstanding bills in order to have their service restored. Wisconsin law requires utilities to make an effort to contact these disconnected consumers and attempt to get them reconnected. However, it is essential to understand that utilities are not obligated to reconnect service until payment arrangements have been made. Outside of the designated winter months span, utility shut-offs can still be prevented if the temperature falls below 32 degrees Fahrenheit or is predicted to do so. In such cases, utility companies are not allowed to disconnect your service for 24 hours or until the temperature rises above 32 degrees Fahrenheit. To summarize, during the winter heating moratorium period, utilities in Wisconsin are prohibited from disconnecting customers who are behind on their bills, specifically including electricity and natural gas. However, customers who have already been disconnected must make payment arrangements to restore their service. Furthermore, outside of the moratorium period, utility shut-offs can be prevented if the temperature falls below 32 degrees Fahrenheit. However, if you have significant debt (such as medical bills or credit card bills ), as well as overdue utility bills you may want to consider filing for Chapter 7 bankruptcy. When does the moratorium for disconnecting customers begin and end? In Wisconsin, a winter utility shut off is banned between November 1st and March 31st. This means that customers who are behind on their bills during this period cannot be disconnected by the utilities. It is important for consumers who have been disconnected to contact their local utility before the start of the winter heating moratorium, which begins on November 1st and ends on April 15th. By doing so, they can make necessary arrangements to have their service reconnected. During this moratorium, customers can have peace of mind knowing that they will not face disconnection even if they are behind on their bills. It is crucial for consumers to take advantage of this protection and communicate with their utility to ensure uninterrupted service during the winter months.

By Credit Solutions

•

06 Dec, 2016

Since bankruptcy and divorce often go hand-in-hand, there are a lot of questions surrounding the issue. The most common question we get are people asking, “ Should I file for bankruptcy before or after divorce? ” It’s a valid question and the answer is not always black-and-white, but there are some things you should consider when deciding if you should file for divorce first or bankruptcy. Making the right decision for your situation is based on a number of factors, including what state you live in, how much property you own, how much debt you have, and what chapter of bankruptcy you want to file. Below, the Credit Solutions’ bankruptcy lawyers have provided some important information to help you with your decision.

By Credit Solutions

•

24 Oct, 2016

Unfortunately, most people file for bankruptcy because of overwhelming medical debt. They’re either unable to pay off their medical bills, or they put a large chunk of their medical debt on a credit card, which has become impossible to pay off. If you need medical debt relief and bankruptcy looks like the only option, review the information below.

By Credit Solutions

•

06 Aug, 2016

Many people who need debt relief don’t know they can negotiate over the amount they owe. While almost anyone who’s in debt can haggle with a creditor to lower the balance they owe, it’s more beneficial to have a bankruptcy lawyer do it because it yields a better debt negotiation outcome & takes the stress off you. Having Credit Solutions handle your debt negotiation can take hundreds to thousands of dollars off what you owe.

By Credit Solutions

•

20 May, 2016

When it comes to major financial commitments, like applying for a home loan, there are various credit score factors that are taken into account. There are 5 credit score categories that can make or break financial opportunities. 1. Payment History: Payment history is one of the biggest credit score factors out there. There are a lot of items factored into assessing your payment history, including: *Missing a payment *Number of missed payments *Time since missed payments *Severity of missed payments Missing 1 payment in ten years is a nothing to worry about as it is a minuscule deduction from your credit score ranking. However, recent missed payments will be weighed heavier. 2. Total Debt: The 2nd largest credit score factor is your total amount of debt. Total debt includes all credit card balances, auto loans, mortgages, and other forms of debt. 3. Length of Credit: The longer you have open credit, the easier it is to determine behavior. 4. Types of Credit: There are 2 types of credit: installment (auto loans and mortgages) and revolving (credit cards). Your credit score is determined by the amount and variety of these credit types. 5. Credit Applications: Every time you apply for a line of credit, your credit history is pulled. Since credit applications are viewed as needing money, the time since your credit history was pulled last is a deciding factor is determining your credit score. Applying for store credit cards to get the additional 15% off sounds like a good idea at the time, but in reality it could be hurting your credit score. It is smart to avoid having lenders pull your credit score unless you are seriously in need of a loan. With a better understanding of credit score factors, you’ll be able to work on building or maintaining good credit. Credit Solutions’ bankruptcy lawyers help thousands of families and individuals get out of debt. We help you find the best way to handle debt and, if needed, we’ll help you file for bankruptcy relief. Our bankruptcy lawyers guide you through the debt relief process from beginning to end, so your finances are manageable again. Set up a FREE consultation now to find the best debt relief plan for you .

By Credit Solutions

•

06 Aug, 2015

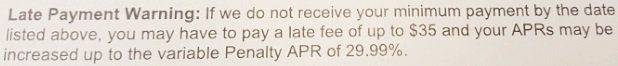

As the country experiences challenging economic times, many people find themselves burdened with substantial credit card debt. If you're unable to continue making credit card payments or choose not to file for bankruptcy, you'll have to face the consequences of credit card debt. So, what exactly happens if you can't pay off your credit card debt? After a few months of non-payment, your debt will be transferred to a collection agency. These agencies will start their collection efforts by calling and mailing notices to your home, aiming to collect payment. It's important to note that collection agencies have the right to contact your family and even your place of employment in order to reach out to you for debt collection purposes. Under the Fair Debt Collection Practices Act, you have a grace period of 30 days before a collection agency can report the delinquent account on your credit report. This can have long-lasting effects on your creditworthiness, potentially hindering your ability to obtain credit in the future until the debt is settled. Furthermore, if the debt remains unpaid even after a civil court judgment is filed against you, the creditor or collection agency can take further action. They may place liens on your wages and assets, garnishing your wages and seizing your assets to cover the debt. In some cases, they may even garnish your bank account, legally withdrawing funds to satisfy the outstanding balance.

By Credit Solutions

•

13 Jan, 2015

How does Chapter 13 bankruptcy give you the best opportunity to get your car back? According to the 7th Circuit Court of Appeals decision, if a vehicle is repossessed prior to the filing of Chapter 13 Bankruptcy, the creditor must return the vehicle to the debtor once the case has been filed and a request for the vehicle's return has been made. This is advantageous for debtors as it allows them to regain possession of their car, which is crucial for maintaining employment and making timely Chapter 13 payments. By having their vehicle returned, debtors can ensure they can commute to and from work, thereby securing their job stability. However, the benefits of Chapter 13 bankruptcy extend beyond vehicle repossession. Not only does it facilitate the return of the car, but it also provides an opportunity to address any outstanding debts associated with the vehicle loan. Through a court-approved repayment plan, debtors can bring their car loan payments current, ultimately regaining control over their financial situation. Moreover, if the repossession has already taken place, filing for Chapter 13 bankruptcy prompts the loan company to return the vehicle to the debtor. This approach offers a practical solution for debtors, granting them a clear path to regain possession of their vehicle while simultaneously addressing their financial obligations. Once the vehicle is returned, debtors are granted a timeframe of three to five years to repay their car loan through the Chapter 13 repayment plan. This extended period allows debtors to manage their finances effectively and make consistent payments towards their vehicle loan, ensuring the opportunity to fully satisfy the debt within a reasonable timeframe. Chapter 13 bankruptcy not only ensures the return of the repossed vehicle but also provides a comprehensive solutions for debtors to address outstanding debts. By offering a court-approved prepayment plan and an extended repayment period, this approach empowers debtors to regain control over their financial situation and retain their means of transportation, thereby securing their employment and enabling the to fulfill their Chapter 14 obligations. Is Chapter 7 bankruptcy a good choice for reclaiming our car? When considering whether Chapter 7 bankruptcy is a suitable option for reclaiming your car from the lender, it is important to note that this particular bankruptcy chapter does not typically enable you to bring your missed payments up to date. As a result, Chapter 7 bankruptcy may not be the most ideal choice if your primary goal is to reclaim your vehicle. However, it's worth mentioning that there are alternative avenues that may allow you to negotiate with the lender for the return of your car. Furthermore, the bankruptcy court might potentially intervene and facilitate the return of the vehicle. Nevertheless, it's essential to be aware that whichever route you pursue, it is likely that you will need to promptly cover all repossession expenses and bring your payments up to date, a task that may be challenging for many individuals. These additional expenses are not needed in a Chapter 13 bankruptcy, making Chapter 13 the right tool to get your car back!

By Credit Solutions

•

06 Jan, 2015

Being in debt is extremely stressful. For some, making sure you stay debt-free after filing bankruptcy can be equally as stressful. Following some basic guidelines can help you stay debt-free. Review your bills and keep track of your records Understand your spending by looking at how much you spend & what you are spend it on. Create and follow a budget after determining your necessary spending. Eliminate the easy stuff first. If you are buying cups of coffee or eating out every day for lunch, start brewing coffee and preparing lunch at home. This alone saves up to $100 or more per month just on simple food costs. Start saving money each month by starting and maintaining a savings account. Set aside a certain amount every month to be deposited into a savings account for years down the road, keeping you debt free after filing for Wisconsin bankruptcy. With small deposits each month coupled with compound interest from a savings account, you can save a lot with just a little. To make it easier to save, a forced savings plan may be ideal. With a forced savings plan, a set amount of money each month is deducted from your checking account and deposited into your savings. If you own a home, make additional mortgage payments each year Paying 1 additional mortgage payment each year can shave years of interest off of what you would spend. You might also consider refinancing to lower your monthly payments to save money now and in the long run. Pay monthly bills on time and in full (when possible) to avoid late fees and higher interest. If you’re over your head in credit card debt , turn to the bankruptcy lawyers at Credit Solutions. We’ll help you with setting up a debt consolidation or repayment plan. If you will still need to file bankruptcy, we’ll determine whether it’s in your best interest to file for Chapter 7 , Chapter 13 or Chapter 128 (a bankruptcy alternative for Wisconsin residents). Setup a FREE consultation with one of our bankruptcy lawyers – just send us some contact info and we’ll get back to you as soon as possible.

Contact the bankruptcy lawyers of Credit Solutions S.C. at 1-866-872-8363

for a debt free future!

BROWSE OUR WEBSITE

CONTACT INFORMATION

Milwaukee Location

626 E. Wisconsin Ave. Ste. 1000

Milwaukee, Wl 53202

Phone: 1-414-272-0077

Toll Free:

1-866-872-8363

Chicago Locations

55 E. Monroe, Suite 3800,

Chicago, IL 60603

Oak Park, 1010 Lake St. Suite 200

Hyde Park, 5113 S. Harper, Suite 2C

Phone: 1-312-801-3000

Toll Free:

1-866-872-8363

SEND US A MESSAGE

Contact Us

Thank you for contacting us.

We will get back to you as soon as possible

We will get back to you as soon as possible

Oops, there was an error sending your message.

Please try again later

Please try again later

CONTACT INFORMATION

Address: 626 E Wisconsin Ave, Suite 1000

Milwaukee, WI 53202

Email: arnoldlueders@gmail.com

Phone: 414-272-0077

SEND US A MESSAGE

Contact Us

Thank you for contacting us.

We will get back to you as soon as possible

We will get back to you as soon as possible

Oops, there was an error sending your message.

Please try again later

Please try again later

Content, including images, displayed on this website is protected by copyright laws. Downloading, republication, retransmission or reproduction of content on this website is strictly prohibited. Terms of Use

| Privacy Policy

Milwaukee Location

Chicago Locations